FOR REVERSE LOAN OFFICER'S ONLY

What Top Lenders Use to Scale — Now You Can Own It

We find homeowners who are in need of a reverse mortgage, qualify them, and book them on your calendar. You only pay if they show up!

Consistently Funds 5 extra loans a month

Ali Sahrai

FUNDED 6 Loans by 3rd Month

John Jameson

5 Submissions First Month

Greg Weber

What Makes Our Operation Different?

We Make it Mathematical impossible for you not to succeed.

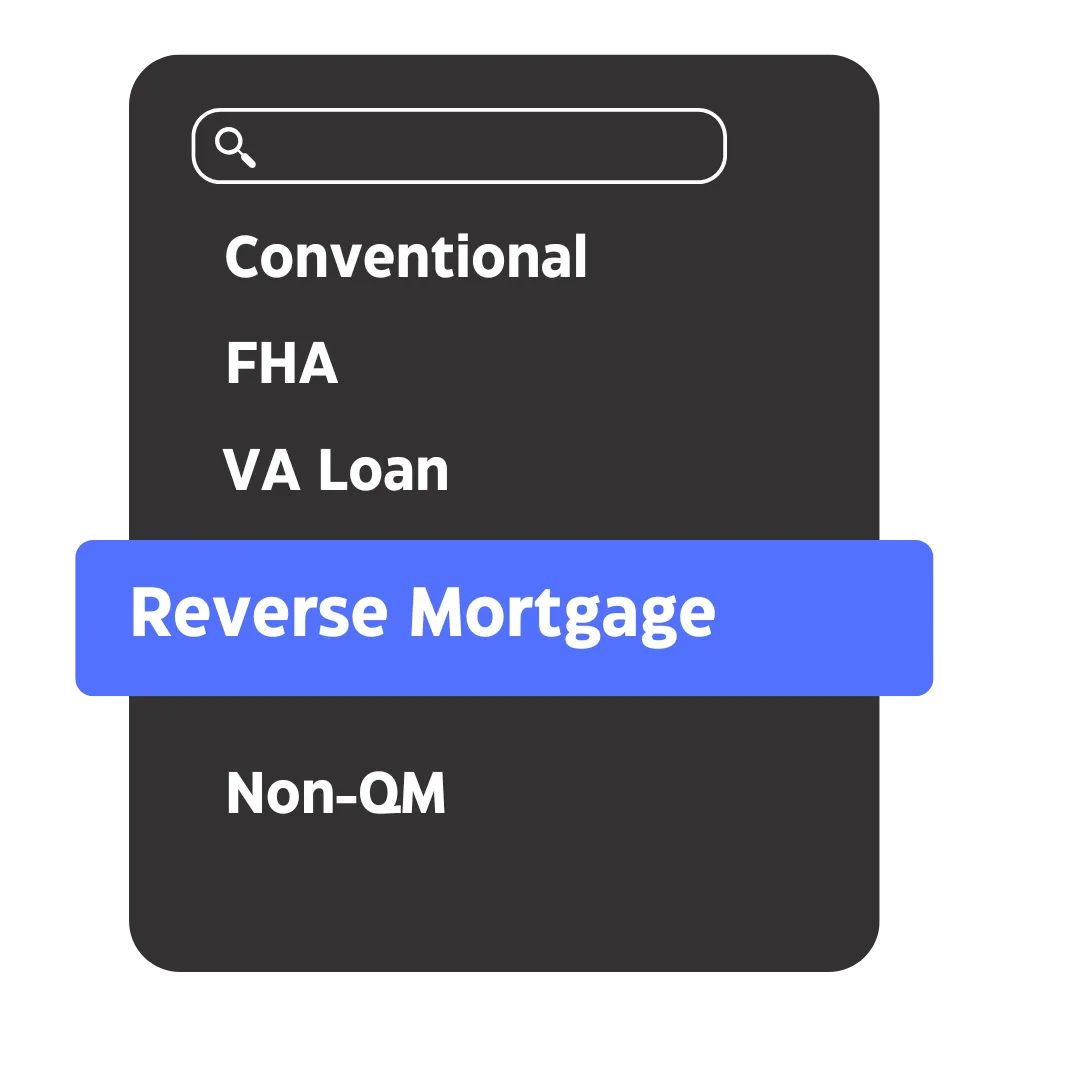

We Are Reverse Focused

A common bottleneck many loan officers face when partnering with marketing agencies or purchasing leads online is the broad focus across multiple niches and products. At MLO Scaling, we channel all our energy into one area: reverse mortgages. This singular focus allows us to approach perfection. We possess deep knowledge of the acquisition process in the reverse mortgage field, ensuring that our strategies are finely tuned and highly effective. Now, we're ready to pass these insights on to you.

We Are Reverse Focused

A common bottleneck many loan officers face when partnering with marketing agencies or purchasing leads online is the broad focus across multiple niches and products. At MLO Scaling, we channel all our energy into one area: reverse mortgages. This singular focus allows us to approach perfection. We possess deep knowledge of the acquisition process in the reverse mortgage field, ensuring that our strategies are finely tuned and highly effective. Now, we're ready to pass these insights on to you.

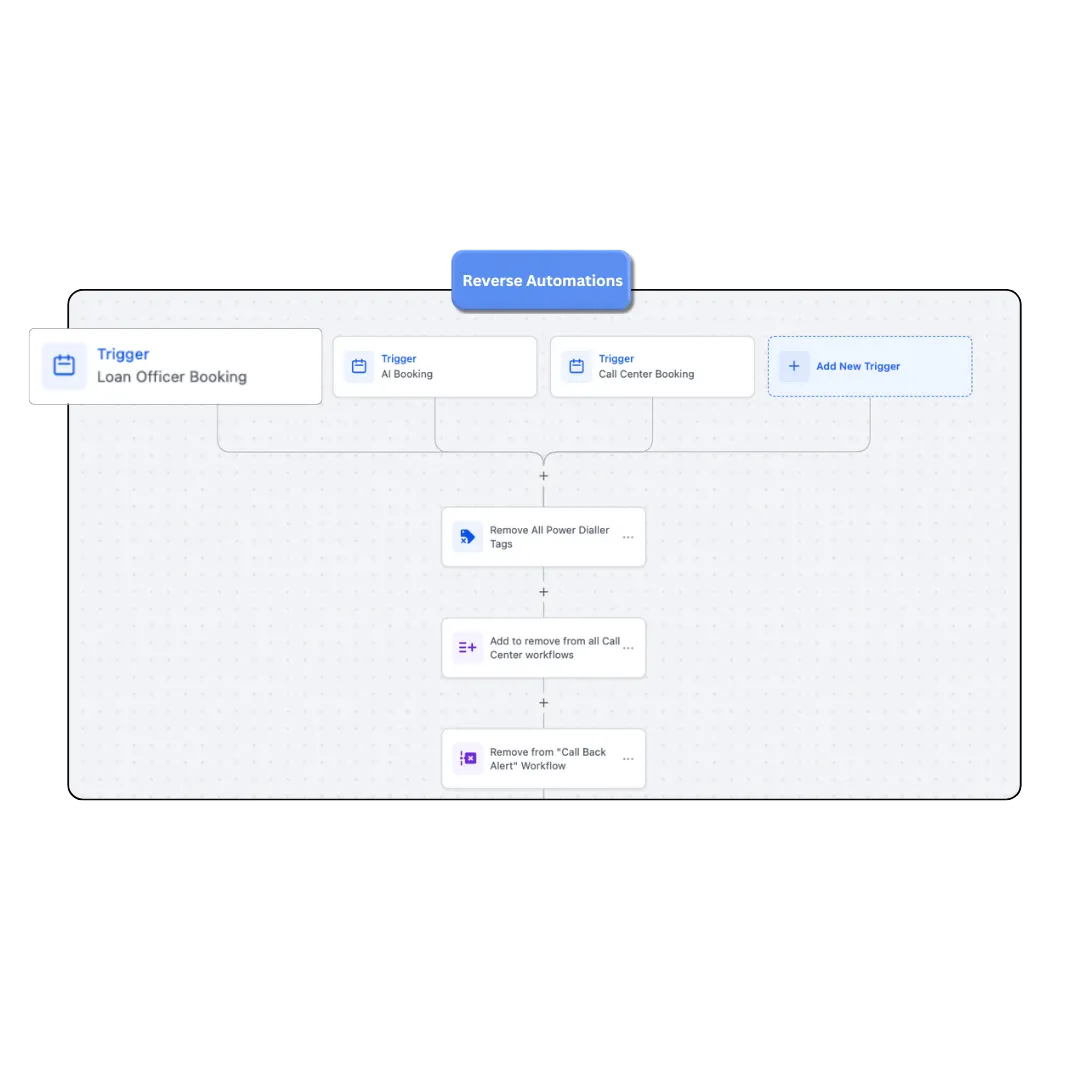

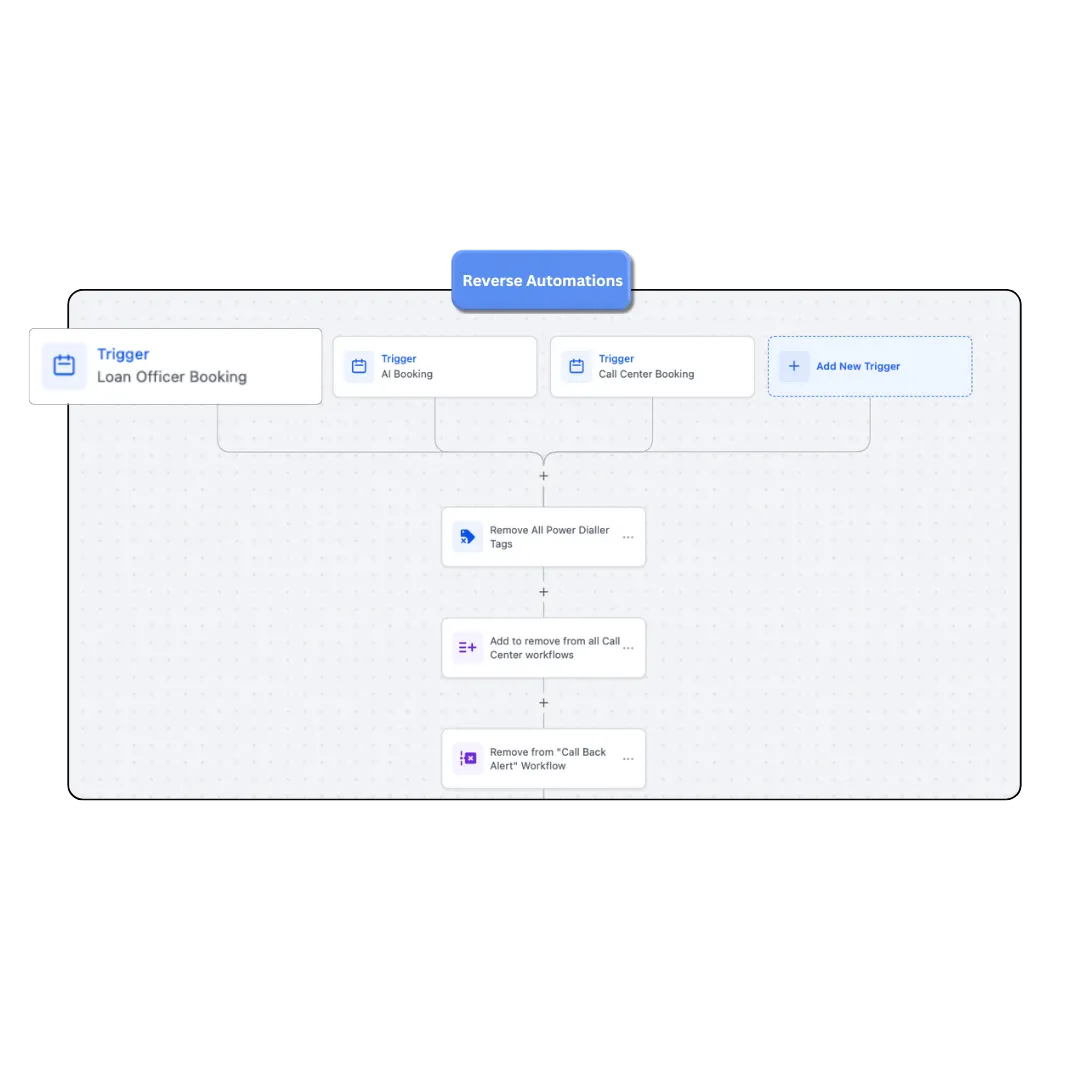

Custom All In House Model

We dive right into your operations, building everything from scratch—automations, AI, and custom marketing campaigns tailored to fit just right. This means every strategy we roll out is designed to sync perfectly with your goals, boosting both efficiency and results. When you work with us, it’s not just about getting help; it’s about getting a partner who’s as invested in your success as you are.

Custom All In House Model

We dive right into your operations, building everything from scratch—automations, AI, and custom marketing campaigns tailored to fit just right. This means every strategy we roll out is designed to sync perfectly with your goals, boosting both efficiency and results. When you work with us, it’s not just about getting help; it’s about getting a partner who’s as invested in your success as you are.

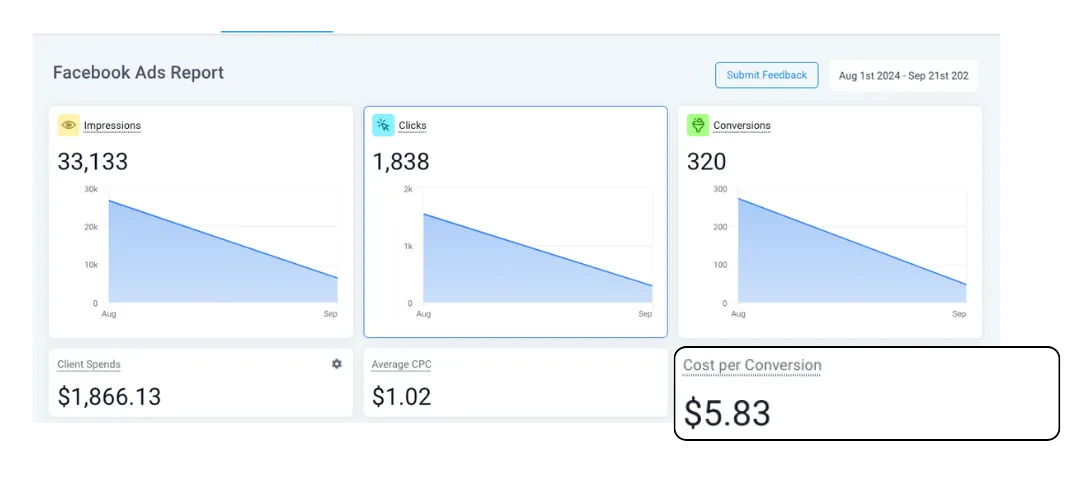

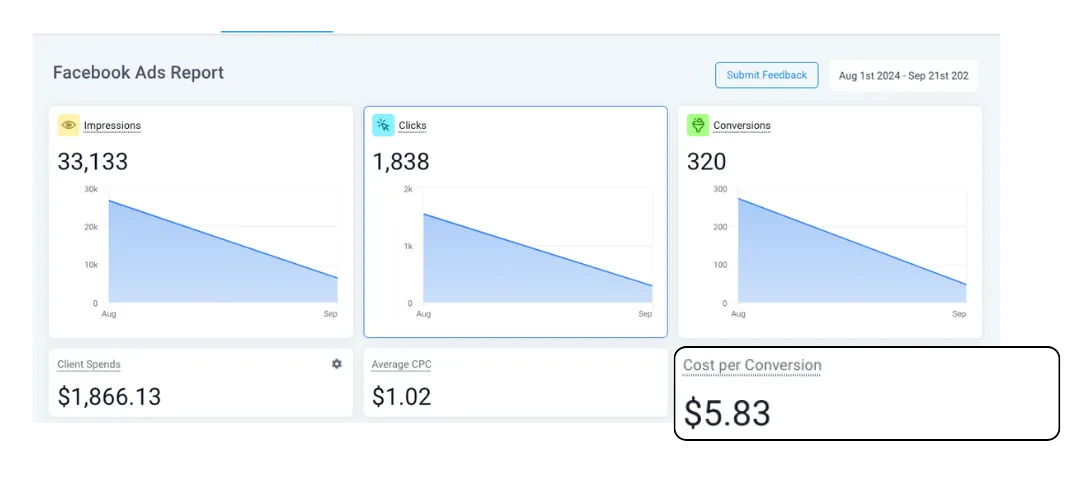

Data Driven Results

Our goal? To make it mathematically impossible not to at least triple your investment with us. How do we do it? By tracking every KPI in your prospecting system. This deep dive into the data lets us set precise goals and craft daily action plans tailored to meet your specific production targets. It's not just about keeping score; it's about continuously optimizing our strategies to ensure you hit—and exceed—your goals.

Data Driven Results

Our goal? To make it mathematically impossible not to at least triple your investment with us. How do we do it? By tracking every KPI in your prospecting system. This deep dive into the data lets us set precise goals and craft daily action plans tailored to meet your specific production targets. It's not just about keeping score; it's about continuously optimizing our strategies to ensure you hit—and exceed—your goals.

Copyrights 2024 | Waizmedia™ | Terms & Conditions